H1 2025 In Review – Tariffs, Market Stabilization & What it Means for the State of Self Storage Development

With a foundation in project management and a current role in business development, MJ Morris brings a unique perspective to the trends shaping the first half of 2025.

June 27, 2025 | Dallas, Texas | Authored by MJ Morris, ARCO/Murray

As 2025 began, I personally held a view of cautious optimism for the self storage development space. In the last 4 months of 2024 alone, we saw:

- 75 bps of interest rate cuts from the Federal Reserve

- Deceleration in rental rate declines in select markets

- 5-10% decreases in construction pricing in certain markets as local subcontractor bases became hungrier for work

Despite some relief in these areas, the overall development pipeline remains challenged as we approach the halfway point of 2025. Only the highest quality opportunities are able to clear the return thresholds that attract capital into the space. Many developers are caught in the tension between wanting to be early movers in the next growth cycle, while not taking undue risk to do so.

Our team has stayed busy amid these headwinds, with 20 different jobs across the country under construction today. Helping our customers navigate the current slate of challenges to push the next wave of projects forward is difficult, but not impossible. Below are some of my observations on two fundamental trends influencing the market today – tariff risk and supply/demand stabilization – and what impact they may have on the sector looking forward.

Tariff Uncertainty

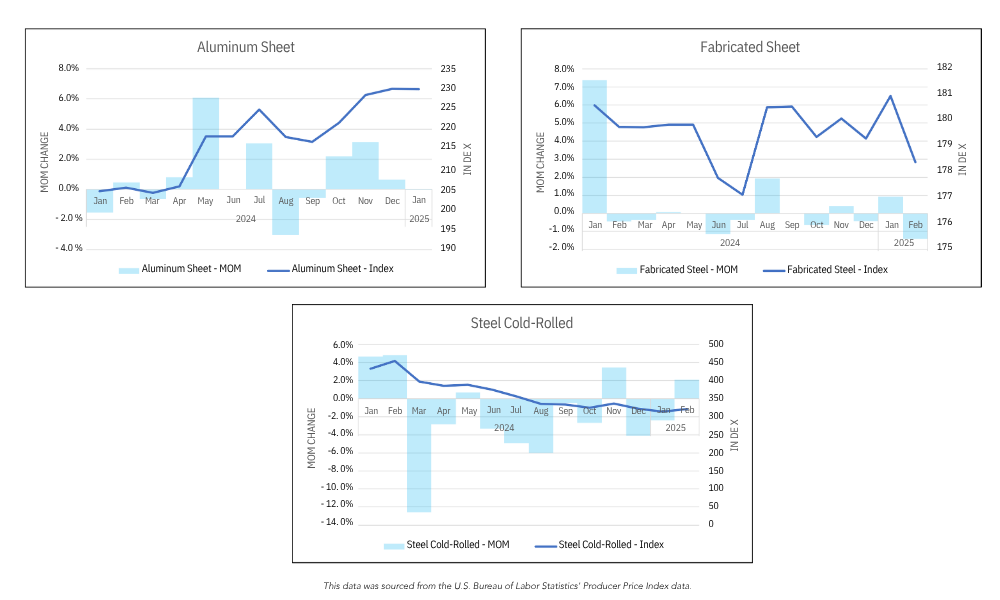

The real impact of tariffs on our business hasn’t been so much input cost escalation on current projects, but the added uncertainty for projects in the pipeline. It remains to be seen whether these tariffs are largely a negotiating tactic or a legitimate program that the administration intends to see through. As with most things, the answer is probably somewhere in between.

Development is an inherently risky business, and pricing fluctuation has been a risk to manage in every market cycle. Storage building boomed in Covid recovery era, despite costs rising 40% over a four-year period. Yet that period also saw record-high occupancy & achieved rental rates, combined with ZIRP-era financing costs. In today’s environment, with rents having more-or-less bottomed out & interest rates more than doubled, project budgets are much more sensitive to pricing shocks. Even the potential for material escalation risk strains many proformas past an investable point for their stakeholders.

Rental Rate Stabilization

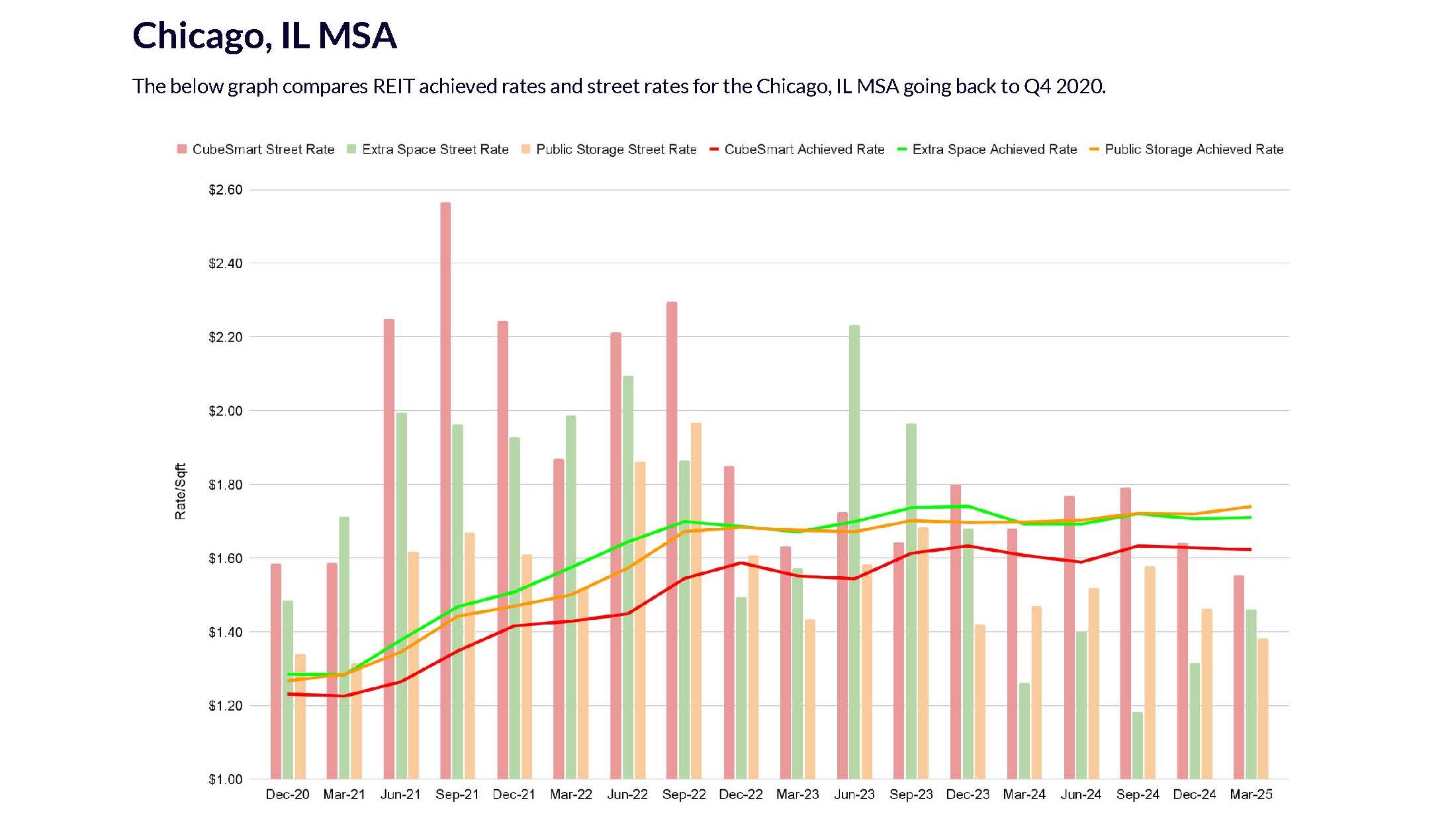

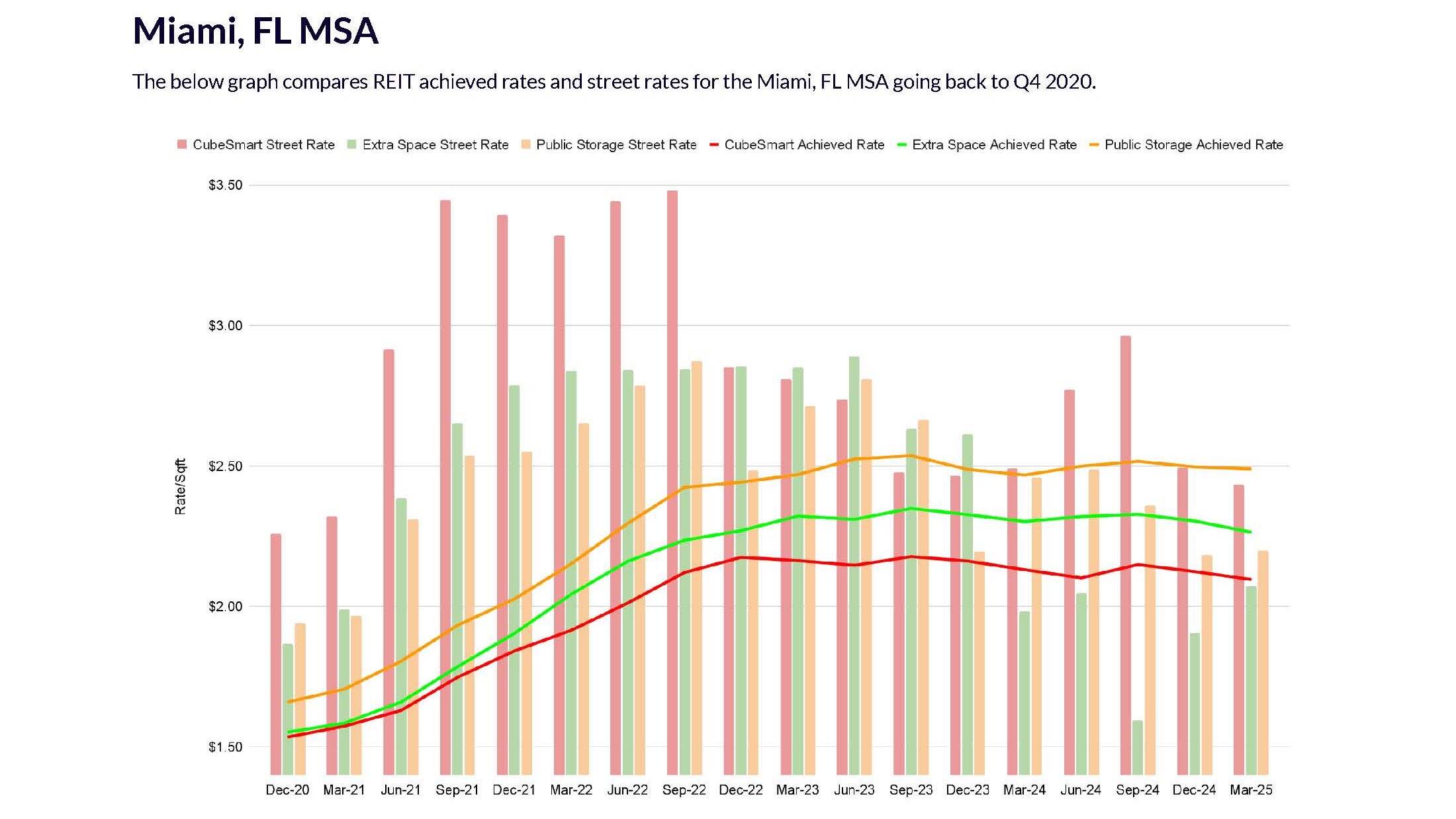

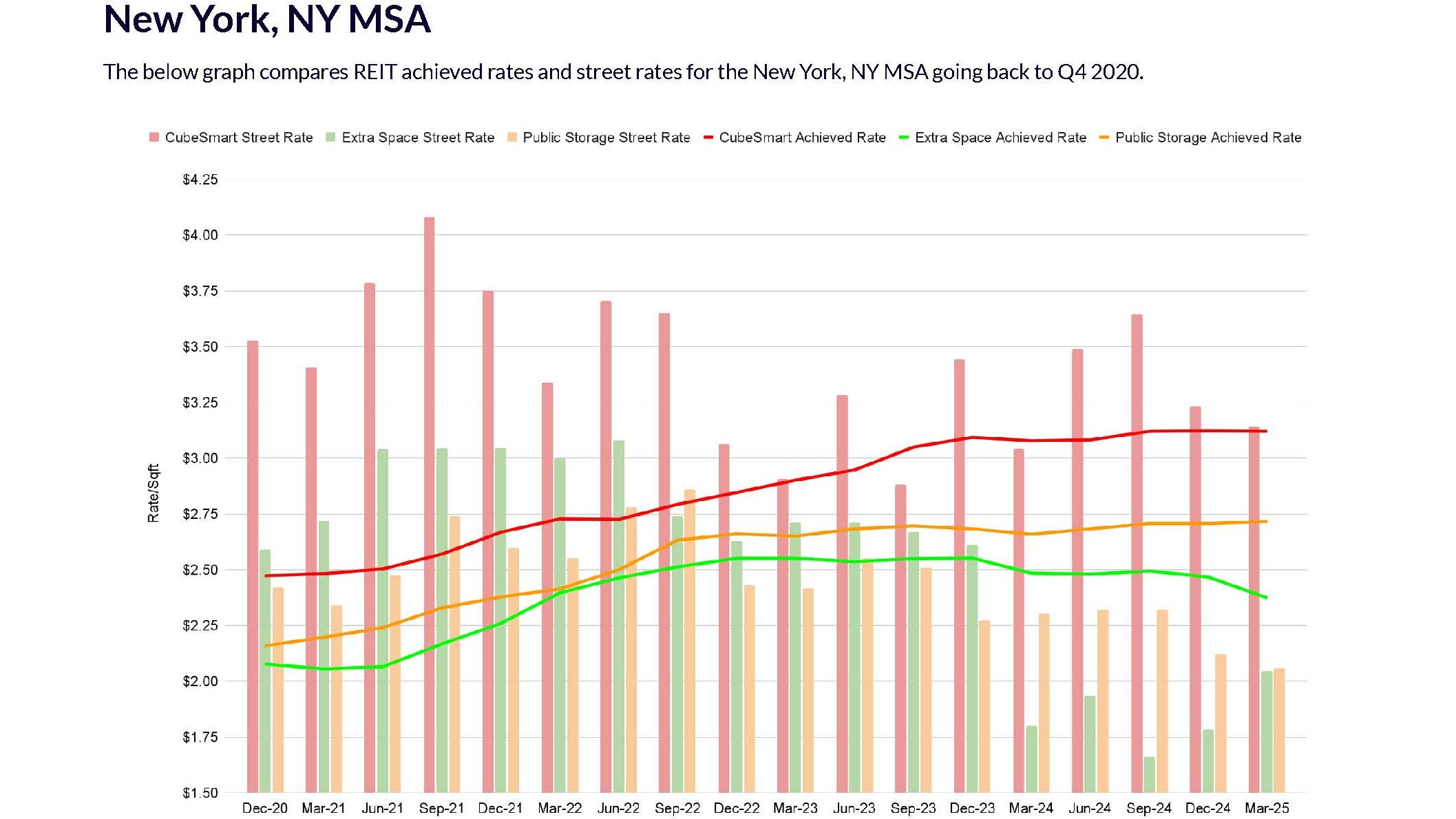

Those owners that already have an established foothold in a given market are welcoming the resulting slowdown in new supply. New facility deliveries are down 30-40% from just a few years ago, and are projected by many to remain suppressed over the next several years. This market correction, while frustrating to some in the short term, signals the start of a lengthy-but-necessary recovery for the storage ecosystem. Green shoots of this recovery are just beginning to emerge, in the form of flattening rental rate declines (if not growth). This is not true across every market, but the broader trend is surfacing in many key cities, beginning with the primary markets with stronger underlying fundamentals (higher barriers to entry, strong demographics and population trends).

This combination of suppressed new deliveries and improving rental outlook would seem to indicate that we’re trudging through the trough of the current development cycle. As markets begin to regain their strength, developers who can find a way to navigate the current slate of headwinds seem poised to deliver into the potential upswing in rental dynamics in their respective cities.

*This data was sourced from the Tract IQ Self Storage REIT Report https://tractiq.com/

Where We’re Headed

Storage development remains challenging, but the macro picture of storage economics appears to be in the early innings of recovery. This momentum needs to continue building on itself for most cities to return to full health & be able to begin absorbing new supply once again. Now more than ever, our team’s focus on identifying and managing risk throughout the development process is helping customers to filter through sites & execute on those increasingly rare development opportunities. The sites that we’re helping customers steward through entitlements today have the potential to deliver into prime market conditions when we look back years from now.